Buying gold and silver for survival is a controversial topic and one of which a lot of survivalists can’t agree on. You may have heard the saying “you can’t eat gold”. Whilst this is true, you can use precious metals to buy food, drinks and other necessities you would need in a survival situation.

Gold, silver and other precious metals are only going to be suitable for survival in a very specific type of scenario. Unless you’re 100% convinced that “sh*t will hit the fan” and modern day currency as we know it ceases to exist completely, I would just continue to buy gold for investment purposes instead.

However, if you’re preparing for long term emergencies, disasters and disruptions in social or political order, gold and silver should be purchased alongside other supplies and not just stockpiled on its own. Food, water, fuel and other necessitates are likely to be very difficult to get your hands on and it won’t matter how much precious metal you have if it’s not in demand.

I guess what I’m trying to say is; if you do decide to buy gold and silver for SHTF, ensure you have all of your other supplies in check first. Food and water should be an absolute priority and as a rule of thumb you should have enough supplies to survive for at least 30 days before you consider buying gold and silver for survival.

Investing in gold and silver for a long term disaster is a win-win situation. The great thing about stockpiling gold and silver is that even if an emergency doesn’t happen, you will have set yourself or your family up for a rather nice payout in later life. It’s still prepping, but prepping for all possible outcomes.

The Industrial Demand For Precious Metals

In 2017, one billion ounces of silver was used by many types of manufacturers. Over 250 million ounces of silver was used for electrical products, such as circuit boards, handhelds and computer chips, whilst over 220 million ounces of silver was used to make jewellery. Silver has high reflectivity and is one of the best metals for electrical and thermal conductivity.

In the same year, 75 million ounces of gold was used by manufacturers, 52% of that by the jewellery industry and 25% of that by gold bullion mints and refineries. Besides its most common use in jewellery, gold can be used in a number of products. Like silver, gold is a very efficient conductor of electricity and as a result, is often used in TV sets and mobile phones. It is also commonly used in dentistry for crowns and fillings as it is fairly malleable and easy to insert.

Since both precious metals are excellent conductors of electricity and heat and have a number of uses including electrical, jewellery, dentistry, bullion markets and many more, the demand for gold and silver will always be on the up, making it a great investment opportunity for times of financial crisis.

Buying Silver For Survival

When it comes to buying precious metals for survival, buying silver is the preferred choice for many survivalists over buying gold. There are a number of reasons why survivalists should lean towards buying silver, it’s cheaper, the value of silver will be more in line with the value of goods that you want to purchase, plus in times of crisis, it won’t make you as much of a target by criminals as opposed to carrying a bag full of gold!

Silver (and gold) has been a precious metal since the beginning of time, and over the centuries its continuously maintained and increased its value, year after year. Preppers recognise the value of silver and stockpile as many ounces of silver as possible to be ready for a financial crisis.

Fiat currency on the other hand is viewed as an unstable option for preppers. It relies on a governing entity such as banks and governments to back up its value. Of course, survivalists see the value in fiat, but in times of financial uncertainty it is not a viable option.

Although in terms of acquisition, mining mineral ore and purifying silver is a lot more involved than printing money, but without financial institutions in place, printed money is useless. Silver is a happy compromise and is more affordable than gold, platinum or palladium making it a sound currency to use if a crisis occurs.

What Silver To Buy For SHTF?

Fortunately there are lots of different options available when it comes to buying silver for SHTF. Silver comes in many forms, weights, types and purities and knowing what to buy can be confusing. As with any type of investment it’s important to plan carefully and diversify your portfolio. Below are the most popular silver investment options available for preppers.

Junk Silver

Previous to 1964, the majority of United States coins were manufactured with 90% silver content. The famous Kennedy Half Dollar, Silver quarters and dimes were all 900 silver, as opposed to today’s coins that have none. If there is a wide scale financial disaster, the chances of stores accepting today’s coins as currency is highly unlikely. It is much more probable that junk silver coins will be accepted due to the high silver content.

The great thing about junk silver coins is that they are widely available from online bullion dealers. You can buy large bags of silver quarters, silver half dollars and other silver bullion coins for extremely affordable premiums. It is recommended to purchase junk silver coins in smaller denominations, so you can transact and barter much easier if the case may be. Buying junk silver coins is considered an easy entry investments for Preppers starting out on a low budget.

Silver Coins & Rounds

Once you’ve stocked up with enough junk Silver coins, Silver Eagles should be your go to bullion coin. American Silver Eagles are manufactured by the US Mint and are made from 99.9% pure silver. If you are in Canada, we recommend the Silver Maple Leaf, If you’re in the UK, The Silver Britannia and Australia, the Silver Kangaroo.

The only issue with these larger coins in a survival situation is they will be harder to transact with. However, all of these bullion coins will be perfect for bartering and are also available in fractional amounts for smaller purchases. The above also applies to silver rounds. When buying silver for survival it is only the silver content that matters, so buying silver rounds of any of the above coins is also acceptable.

Silver Bars & Ingots

Silver bars and silver ingots are available to buy in all sizes, and a small amount of your stockpile should be made up of these. You will only be using silver bars for larger purchases and exchanges so it’s up to you to calculate the amount of silver bars you will personally require in a survival situation.

Valcambi sell silver CombiBars in sheets of 100 x 1 gram bars. CombiBars are sheets of multiple bars which can be easily snapped off and divided into single bars. These will be ideal in a survival situation and each

1 gram bar would be perfect for buying a loaf of bread at silver’s current price.

Check prices for 1 gram silver bars here…

Testing Silver Bullion

When buying silver for survival you want to ensure that you are buying genuine silver. Although silver is not as valuable as gold, you’d be surprised at just how much fake silver, alloy or metal that looks like silver (especially on the scrap market) is available. The best place to buy silver is a website like our own that lists official silver dealers or by purchasing silver directly at the mint or refinery. When buying silver for SHTF, scrap silver is a popular option. Below are the top five DIY silver identification tests you can do easily at home.

Stamp Test – One of the easiest ways to identify silver is by looking for a makers stamp or hallmark. Because silver is produced on a mass scale and each country has its own regulations, not every piece is marked, but, if you keep an eye out for the numbers 800, 900, 925 and 999 it’s a pretty good rule of thumb. A stamp of 800 means 80% silver, 20% alloy, a stamp of 999 means 99.9% silver, 0.1% alloy and so on…

Acid Test – This method is the safest and most effective way of identifying silver at home. Not only can you identify whether or not your piece is silver, but you can identify the purity also. To test, find an inconspicuous area on the piece that you can scratch, apply a small drop of acid and compare the reaction to the chart supplied with your kit to identify your silver.

Ring Test – The ring test works best for silver coins. When silver is hit with another metal, it makes a very recognisable “bell-ringing” noise. Simply drop the coin from 2-3 feet above a flat surface, if when the coin hits the surface it rings like a bell, chances are that you have silver, if it’s a dull noise it’s likely mixed with other alloys.

Bleach Test – When applying a powerful oxidising agent to silver it tarnishes extremely easy. In an inconspicuous area on your piece, apply a tiny drop of bleach, if it turns black almost instantly, chances are you are dealing with real silver.

Ice Test – Place an ice cube directly on your piece of silver. If the ice cube starts to melt immediately as if it was placed on a hot surface, you most likely have real silver. This is a simple test that works best with silver coins and silver bars, but not so well with silver jewellery.

Buying Gold For Survival

The problem with buying gold for survival is that it’s expensive. Although buying gold is essential for survival, buying large gold bars, gold bricks and ingots is probably not a wise move. Not only does buying gold in large amounts make you a target for criminals, but it certainly makes things a lot harder if you need to pop out to buy a pint of milk. Unless you’re purchasing an expensive item, paying for smaller items with large gold bars will be difficult because unless the seller has some kind of change, the chances are you are going to overpay.

Although there is no doubt that gold bullion should make up part of your survival investment portfolio, you will need to calculate what is the right amount of gold to be holding for your specific situation. Bear in mind, that when a financial crisis hits you are more likely to be wanting to survive as opposed to be purchasing lavish items so stockpiling ounce upon ounce of gold bullion just for survival is probably not the best idea. Diversify your portfolio as much as possible and ensure you have enough of everything for every possible scenario.

What Gold To Buy For SHTF?

As with buying silver, when you buy gold for survival you should carefully plan and diversify your investment. Below we discuss the most popular gold invention options for preppers.[/vc_column_text][/vc_column]

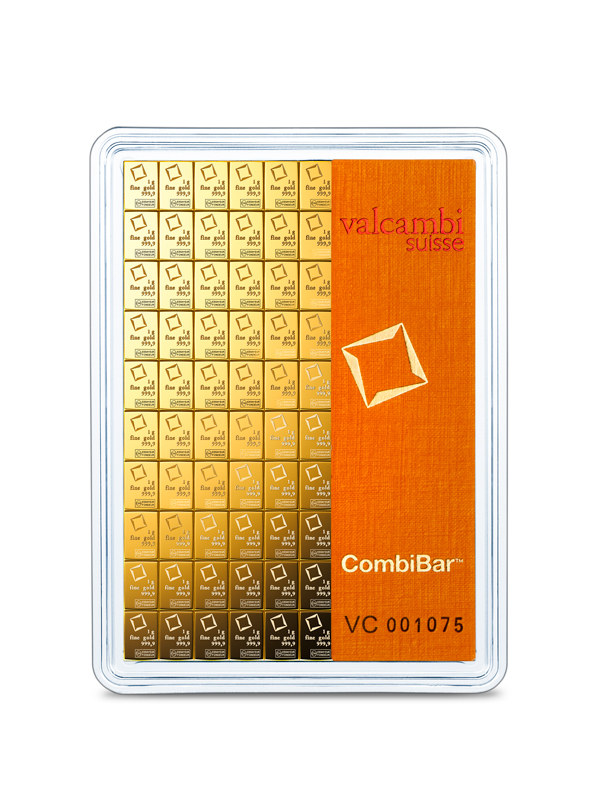

Buy Gold CombiBars

Just like the silver CombiBars or MultiGrams mentioned earlier in this article, CombiBars are also available in gold bullion. Gold CombiBars usually come in multiples of 1gm of gold bullion. Gold CombiBars come in sets of 25, 50 or 100 x 1gm bars and will make the perfect currency for small-medium sized purchases. Individual 1-gram pieces can be snapped off and used as currency without any loss of other material. Not only will you be able to buy items with a smaller wafer of gold, the chances of the seller being able to provide change in the form of gold and silver are much, much higher. Valcambi exclusively manufacture the gold CombiBar, but 1gm gold bars are also available in blister packs from a variety of reputable mints, refineries and bullion dealers.

Check prices for 1 gram gold bars here…

Fractional Gold Coins

Although it’s advisable to stock up on some larger denomination gold coins, you should really consider investing the majority of your gold coin budget into fractional gold coins that are valued at lower premiums. Similarly to buying gold bars and ingots, you will require fractional gold coins to ensure you don’t overpay for supplies and can barter and transact much easier in the case of SHTF.

Fractional gold coins can be purchased singularly making them an affordable investment whilst you prepare for a crisis, alternatively most popular gold coins can be purchased in rolls or tubes, usually of 10 or 25 coins. For US readers we’d advise purchasing Gold Eagles, if you are based in Canada, the Gold Maple Leaf and if you live in the UK, the Gold Britannia. All of these coins are available in rolls and tubes and the smallest weight available is 1/10 oz making them ideal for gradual investments and making purchases during a financial disaster.

Scrap Gold

Scrap gold should make up a small percentage of your SHTF precious metal collection. We suggest collecting a variety of 9ct, 18ct and 24ct gold jewellery and other small gold items that could later either be traded or smelted into gold bullion bars and ingots.

We don’t recommend buying scrap gold coins since they will have higher prices due to being more attractive for coin collectors. Unlike older silver coins which are valued more on their silver content, gold coins can attract much higher interest from collectors and you are likely to pay over the odds.

Testing Gold Bullion

When buying gold bullion for survival, you need to ensure you are purchasing real gold, after all, what use is fools gold in a survival situation? Of course, if you are buying gold online from reputable dealers such as the mints, refineries and retailers listed on our website, you won’t have any issue. All reputable bullion dealers ship gold bars and coins with an assay card and authenticity certificate so you can be sure what you are purchasing is legitimate gold bullion.

But, if you are buying scrap gold or secondhand gold from sellers you don’t necessarily trust, you need to know that what you’re buying is the real McCoy. A recent report in the UK, claims that over a third of gold sold on websites like eBay and Amazon could be fake, so it’s always best to test your gold properly or buy from a trusted retailer. Below are five of the most popular DIY methods to test Gold at home.

Stamp Test – Check the piece of gold for a jewellery stamp or hallmark. Unless the gold is pre 1900, the majority of gold bullion whether it be a gold bar, coin or jewellery it will have some kind of hallmark stating the karat, purity of the gold and the makers mark. Steer clear of gold that has “HGP” (Heavy Gold Plate), “GF” (Gold Filled) or “HEG” (Heavy Electroplated Gold).Magnet Test – One of the simplest DIY gold tests is to use a magnet. Gold is not magnetic. You’ll need a stronger than usual magnet to hold close to the metal, and if it doesn’t attract, the chances are you have real gold. Be careful though when testing jewellery as often clasps and fittings can be made from magnetic material.

Acid Test – By applying nitric acid to your gold you can easily tell whether it’s legitimate bullion or not. Simply make a very small scratch on the alleged gold and drop a tiny amount of nitric acid to the blemish. If the acid turns green, it’s not gold, if it goes milky, you have gold on silver and if it doesn’t react at all you have real gold bullion.

Float Test – Drop your gold into a mug of water, if it floats the gold is fake, if it sinks it’s likely to be real gold. Also real gold does not rust. Rust is another word for iron oxide which is formed when iron is exposed to oxygen and moisture. Gold contains no iron, so if it rusts after getting wet, your gold is fake.

Skin Test – It’s true what they say about gold discolouration if it’s not real. Hold the gold tightly in your hand for 3-4 minutes until you start to perspire slightly, check your skin for green or black marks from the metal. If you find any marks on your hand there is no doubt you’re metal is mixed with other alloys and is not real gold.

Important Note

The above are the most popular DIY methods for testing gold, but they aren’t 100% accurate, the safest way to ensure your gold is 100% genuine is to buy gold online from a reputable mint or dealer or take your gold to a consultant or jeweller who can verify its authenticity.

How to Store Gold & Silver For Preppers

So now you’ve bought your gold and silver for survival, you need to find somewhere safe to store it. If history is anything to go by, investors of precious metals will become targets in times of financial crisis. Whether it be unwanted attention from criminals or even from the government (who famously confiscated gold and silver from citizens during the Great Depression) you need to ensure your gold and silver is A) inaccessible to others and B) easily accessible for you. It’s a difficult balance.

Gold Storage Options

Storing precious metals in banks or safety deposit boxes may sound appealing to you. This method of storage will no doubt keep the criminals at bay, and insurance is available in case of theft, but, the problem with safety deposit boxes is they are stored inside the bank. Today your precious metal is easily accessible, but when a true breakdown of society hits, just how accessible will they become? Chances are you can kiss good bye to your beloved bullion.

A popular storage option for preppers is to store silver and gold is at your own property. However, this does come with its own “obvious” risks. As long as you don’t tell everyone who’s everyone you have hoards of gold stocked at your property, you should be alright, but you still need to be careful when it comes to storage due to preservation and accessibility.

First things first, you should buy some protective sleeves and covers for your bullion so to protect it from the elements, scratches and wear. All new bullion coins and bars come with protective sleeves but if you have purchased secondhand gold and junk silver it makes sense to preserve it is much as possible.

Cold temperatures are ideal for gold and silver, whether it be a discreet container in your fridge/freezer, a secret compartment under your floorboards or some unused plastic pipe from an old plumbing system, there are lots of suitable hiding places for gold and silver around the home. Just remember to take a mental note of everywhere it’s hidden, the last thing you want to do is forget where you’ve stored it!

It’s probably not advisable to store all of your precious metals at home. You can place some of your investment in privately insured vaults either in your country of residence or even offshore. However, the jury is out amongst survivalists on just how accessible these vaults would be in a survival situation. Paid vaults are the next best option after storing your gold at home, and if anything it will ensure your gold is more easy to access than if it was in a bank.

When looking for private gold storage, ensure that the company keeps the physical gold in their vaults. You want to know that if society does breakdown you can go straight to the vault and remove your investment. If they don’t, you shouldn’t do business with them.

There are many considerations to make when storing your precious metals for survival, each option has its pro’s and con’s. Make sure you do your research and search online before making any important decisions regarding gold storage.

When Do I Make Money On My Investment?

As opposed to just buying precious metals as a trader would and selling them a few years later for profit, buying gold for survival purposes is primarily about converting fiat currency to a physical asset and enjoying any profits later when it becomes critical to sell.

The gold and silver you purchase now, should be used the same as any other survival supplies that you purchase – to be used only as and when you need it. There’s no point keeping an Eagles eye on the market expecting to get rich overnight. Instead, play the long game of protecting your hard earned cash by hedging it against inflation in the form of a physical asset.

Keep an eye on prices and when gold and silver is on a low add a little more to your stockpile. Just remember, when buying gold for SHTF you need to forget the trader mindset of buy low and sell high. By all means by low, but only sell if your life depends on it. You’re a prepper, not a trader and if a financial crisis never happens, in your later years you will be sitting on a highly profitable nest egg of precious metals that you can either enjoy yourself or pass down to your family as inheritance.

20 Years of Gold Investment

Will Gold and Silver Hold Their Value In The Future?

Survivalists and investors believe that the price of precious metals such as gold and silver will increase in the case of a survival situation. It only makes sense that if the stock markets turn bearish, that investors and traders will turn to precious metals as a safer vehicle for their investments.]During the credit crisis of 2008, markets crashed, prices dropped rapidly and the precious metals market was flooded with new money. Although previous price history is not a solid indicator of future results, it proves the psychological concept that investors seek safer and physical investment products during times of crisis.

In the long term, physical gold and silver is considered a stable investment with value increasing pretty much year after year. Although the market has seen a few peaks and troughs, most preppers and survivalists see silver and gold as a financial safeguard and sound investment opportunity both for wealth preservation and day-to-day transactions.

Conclusion

Buying gold and silver bullion for survival is a controversial subject within the survivalist community. Some will recommend buying gold and silver, whilst others will completely oppose it. As with any kind of investment you are advised to do your own research before committing to any large purchases, this includes the amount that you buy, the diversity of your purchase and also where you store your precious metals.

A good way to start buying gold and silver for survival is by setting aside a small amount of budget for precious metals each month. Even if you budget $100 on a monthly basis, after 1 year you’ll be surprised just how much silver and gold you can accumulate.

When investing in precious metals for a survival situation, just make sure you are spending your budget equally on other important supplies such as food, water and other emergency items. Part of being a prepper is “preparing” correctly for any possible situation. As with all things in life, finding a happy balance is of utmost importance.